Composite cost-of-borrowing indicator for new loans to corporations increased by 22 basis points to 3.85%; indicator for new loans to households for house purchase increased by 14 basis points to 3.24%, both driven by interest rate effect. Composite interest rate for new deposits with agreed maturity from corporations increased by 30 basis points to 2.31%; interest rate for overnight deposits from corporations increased by 8 basis points to 0.31%, both driven by interest rate effect. Composite interest rate for new deposits with agreed maturity from households increased by 28 basis points to 1.92%, driven by interest rate effect. And the interest rate for overnight deposits from households were broadly unchanged, at 0.12%.

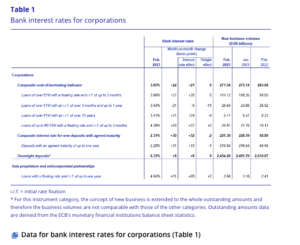

Bank interest rates for corporations

The composite cost-of-borrowing indicator, which combines interest rates on all loans to corporations, increased, driven by the interest rate effect in February 2023. The interest rate on new loans of over €1 million with a floating rate and an initial rate fixation period of up to three months increased by 27 basis points to 3.68%. The rate on new loans of the same size with an initial rate fixation period of over three months and up to one year fell by 21 basis points to 3.54%, driven by both the interest rate and the weight effects.

The interest rate on new loans of over €1 million with an initial rate fixation period of over ten years increased by 21 basis points to 3.41%. In the case of new loans of up to €250,000 with a floating rate and an initial rate fixation period of up to three months, the average rate charged rose by 26 basis points to 4.39%.

As for new deposit agreements, the interest rate on deposits from corporations with an agreed maturity of up to one year rose by 31 basis points to 2.28% in February 2023. The interest rate on overnight deposits from corporations rose by 8 basis points to 0.31%.

The interest rate on new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial rate fixation period of up to one year increased by 31 basis points to 4.54%.

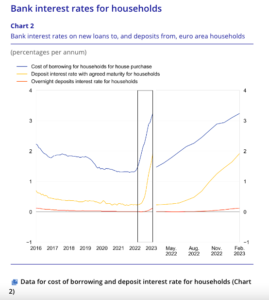

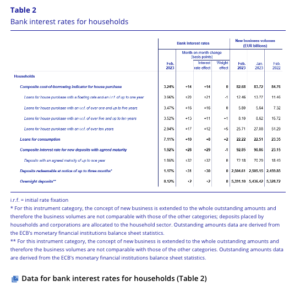

Bank interest rates for households

The composite cost-of-borrowing indicator, which combines interest rates on all loans to households for house purchase, increased, driven by the interest rate effect in February 2023. The interest rate on loans for house purchase with a floating rate and an initial rate fixation period of up to one year increased by 20 basis points to 3.66%. The rate on housing loans with an initial rate fixation period of over one and up to five years rose by 16 basis points to 3.47%.

The interest rate on loans for house purchase with an initial rate fixation period of over five and up to ten years increased by 13 basis points to 3.52%. The rate on housing loans with an initial rate fixation period of over ten years rose by 17 basis points to 2.94%. In the same period the interest rate on new loans to households for consumption increased by 10 basis points to 7.11%.

As for new deposits from households, the interest rate on deposits with an agreed maturity of up to one year increased by 32 basis points to 1.85%. The rate on deposits redeemable at three months’ notice rose by 31 basis points to 1.17%. The interest rate on overnight deposits from households remained broadly unchanged at 0.12%.

Further information

Tables containing further breakdowns of bank interest rate statistics, including the composite cost-of-borrowing indicators for all euro area countries, are available from the ECB’s Statistical Data Warehouse. A subset is visually presented on the Euro Area Statistics dedicated website. The full set of bank interest rate statistics for both the euro area and individual countries can be downloaded from SDW. More information, including the release calendar, is available under “Bank interest rates” in the statistics section of the ECB’s website.

Source: ECB