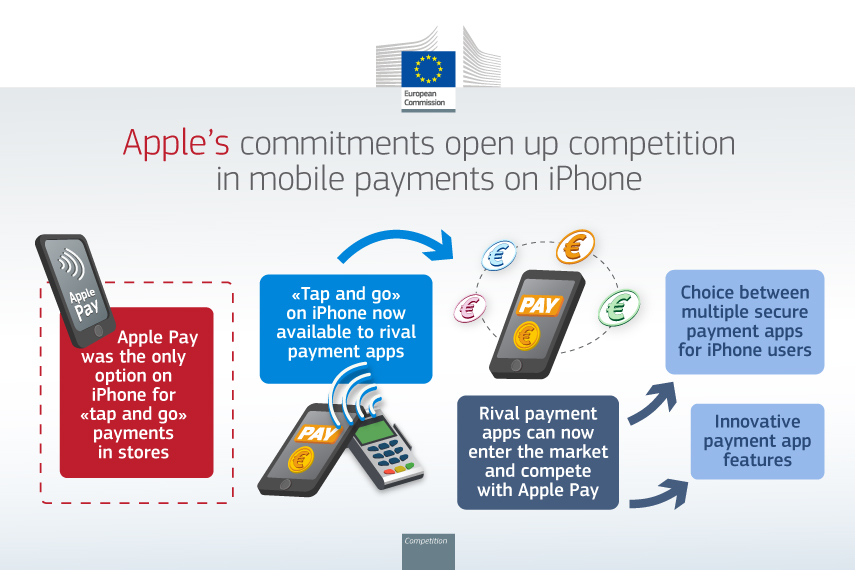

The European Commission has made commitments offered by Apple legally binding under EU antitrust rules. The commitments address the Commission’s competition concerns relating to Apple’s refusal to grant rivals access to a standard technology used for contactless payments with iPhones in stores (‘Near-Field-Communication (NFC)’ or ‘tap and go’).

The Commission’s competition concerns

Apple Pay is Apple’s own mobile wallet used to allow iPhone users to pay with their devices in stores and online. Apple’s iPhones run exclusively on Apple’s operating system ‘iOS’. Apple controls every aspect of its ecosystem, including access conditions for mobile wallet developers.

The Commission preliminarily found that Apple has significant market power in the market for smart mobile devices and a dominant position on the in-store mobile wallet market on iOS. Apple Pay is the only mobile wallet that may access the NFC hardware and software (‘NFC input’) on iOS to make payments in stores, as Apple does not make it available to third-party mobile wallet developers.

In its investigation, the Commission preliminarily concluded that Apple abused its dominant position by refusing to supply the NFC input on iOS to competing mobile wallet developers, while reserving such access only to Apple Pay.

The Commission’s preliminary view is that Apple’s refusal excluded Apple Pay’s rivals from the market and led to less innovation and choice for iPhone mobile wallets users.

Such behaviour may breach Article 102 of the Treaty on the Functioning of the European Union (‘TFEU’), which prohibits the abuse of a dominant position.

The commitments

To address the Commission’s competition concerns, Apple initially offered the following commitments:

- To allow third-party wallet providers access to the NFC input on iOS devices free of charge, without having to use Apple Pay or Apple Wallet. Apple will enable access to NFC in Host Card Emulation mode (‘HCE’). HCE allows to securely store payment credentials and complete transactions using NFC, without relying on an in-device secure element.

- To apply a fair, objective, transparent and non-discriminatory procedure and eligibility criteria to grant NFC access to third-party mobile wallet app developers.

- To enable users to easily set an HCE payment app as their default app for payments in stores and to use relevant functionalities such as Field Detect (which opens the user’s default payment app when a locked iPhone is presented to an NFC reader), Double-click (which launches the default payment app when double clicking the phone’s side or home button), and authentication tools such as Touch ID, Face ID, and device passcode.

- To establish a monitoring mechanism and separate dispute settlement system to allow for independent review of Apple’s decisions restricting access.

- To apply the abovementioned commitments to all third-party mobile app developers established in the European Economic Area (‘EEA’) and to all iOS users with an Apple ID registered in the EEA, also while traveling temporarily outside the EEA.

Between 19 January 2024 and 19 February 2024, the Commission market tested Apple’s commitments and consulted all interested third parties to verify whether they would remove its competition concerns. In light of the outcome of this market test, Apple amended the initial proposal and committed:

- To extend the possibility to initiate payments with HCE payment apps at other industry-certified terminals, such as merchant phones or devices used as terminal (so called SoftPOS), if this is enabled.

- To explicitly acknowledge that HCE developers are not prevented from combining the HCE payment function with other NFC functionalities or use cases.

- To remove the requirement for developers to have a licence as a Payment Service Provider (‘PSP’) or a binding agreement with a PSP to access the NFC input.

- To allow NFC access for developers to pre-build payment apps for third party mobile wallet providers.

- To update the HCE architecture to comply with evolving industry standards used by Apple Pay, and to continue to update standards even if they are no longer implemented by Apple Pay, under certain conditions.

- To enable developers to prompt users to easily set up their default payment app and redirect users to the default NFC settings page, enabling defaulting with only a few clicks.

- To comply with the same industry standard-specifications as developers of HCE payment apps and to protect confidential information obtained in the context of an audit.

- To shorten deadlines for resolving disputes. Moreover, Apple offered additional independence and procedural guarantees for the monitoring trustee.

The Commission concluded that Apple’s final commitments would address its competition concerns over Apple’s restriction of third-party mobile wallet developers’ access to NFC payments in stores for EEA iOS users. It therefore decided to make them legally binding on Apple.

The commitments will remain in force for ten years and apply throughout the EEA. Their implementation will be monitored by a monitoring trustee appointed by Apple who will report to the Commission for the same time period.

Apple’s commitments are without prejudice to Apple’s current or future obligations under other regulations, in particular relating to other use cases and functionalities within the scope of the Digital Markets Act (Regulation 2022/1925) and the implementation of the Digital Euro.

Background

Article 102 of the TFEU prohibits the abuse of a dominant position that may affect trade within the EU and prevent or restrict competition. The implementation of this provision is defined in Regulation No 1/2003, which can also be applied by the national competition authorities.

Following the opening of a formal antitrust investigation into Apple’s behaviour in June 2020, the Commission sent Apple a Statement of Objections in May 2022. In January 2024, the Commission market tested Apple’s first set of commitments. In parallel to today’s Article 9 commitments decision, the Commission also adopted today a second decision closing its investigation into online restrictions and alleged refusals of access to Apple Pay for specific products of rivals that the Commission also opened in June 2020. This second decision also closes all proceedings in relation to the UK, which no longer forms part of the EEA.

Article 9 (1) of Regulation 1/2003 enables companies investigated by the Commission to offer commitments in order to meet the Commission’s concerns and empowers the Commission to adopt a decision to make such commitments binding on the companies. Article 27(4) of Regulation 1/2003 requires that before adopting such decision the Commission shall provide interested third parties with an opportunity to comment on the offered commitments.

If the market test indicates that the commitments are a satisfactory way of addressing the Commission’s competition concerns, the Commission may adopt a decision making the commitments legally binding on the company concerned. Such a decision would not conclude that there is an infringement of EU antitrust rules but would legally bind the company to comply with the commitments it has offered.

If the company concerned does not honour such commitments, the Commission may impose a fine of up to 10% of its total annual turnover, without having to find an infringement of EU antitrust rules, or a periodic penalty payment of 5% per day of its daily turnover for every day of non-compliance.