by Elfriede Sixt

EFRI, an association based in Vienna, Austria, set up in spring 2020, by now represents more than 1.052 European consumers who were defrauded by cybercriminals as of writing over EUR 59,2 million in the form of investment scams also referred to as boiler room scams. HSBC, one of the world’s largest banks, is known for being a “dirty” bank. It is public knowledge that HSBC for decades has laundered hundreds of millions of dollars for Mexican drug cartels and HSBC took a prominent role in about all scandals which evolved during the past years: Panama Papers, Swiss Leaks, … (a video on the history of HSBC and its involvement in crimes can be watched here). So probably it is not surprising that this “dirty” bank is also heavily involved in Cybercriminal activities.

Cybercrime becomes a plague

Law enforcement worldwide are emphasising that the extent of cybercrime is progressing at an incredibly fast pace. As a matter of fact it is not only the pandemic, Cybercriminals are becoming more agile, exploiting new technologies with lightning speed, tailoring their attacks using new methods, and cooperating with each other in industrial style ways we have not experienced before.

Transnational criminal networks operate across the world, coordinating intricate attacks in a matter of minutes and damaging and hurting people worldwide.

But do not think that only the creative scammers are to be blamed, we also blame the financial system for not caring about their contribution to the raids going on by the scammers, and we also blame the financial supervisory authorities worldwide for not having addressing the cybercrime issue properly for years and still not having realised the extent of crime and the danger looming around the corners.

Banks are supposed to be gatekeepers for the financial system

The use of the incumbent financial system is one of the most critical success factor for the scammers in addition to sophisticated software tools, aggressive marketing, fraudulent affiliate campaigns and unscrupulous call center employees. Even if cryptocurrencies are involved, the scammers always need the incumbent financial system to cash out.

Without the processing of illicit proceeds, used to fund serious criminal activities, the lifeblood of the scammers operations is disrupted.

The role of being the gatekeeper for any misuse of the incumbent financial system for banks and financial institutions can not be overemphasised and stopping the financial industry to support the scammers will most probably finally turn out to be the only possibility to stop the scammers.

But right now by checking out the available bank documentation from victims and prosecutor files, it gets evident that banks like Deutsche Bank, ING and HSBC are just marketing heavily on their websites about their great global standardised AML programs, but evidently they do not apply them, they just do not care.

HSBC involvement in fraud

For example notwithstanding HSBC’s public “marketing” campaign to have implemented and abide by state-of the art compliance programs, the bank and its subsidiaries have paid over USD 6.5 billion in civil penalties since 2000, in total 59 violations have been registered.

EFRI represents 145 (63+82) European retail investors who have lost more than EUR 13.7 (1.9+11.5 + 1.3) Mio of their life savings to transnational criminal organisations which made use of the HSBC payment system[1] to intake the stolen money, to launder it and to garner the proceeds of crime. Thereof 82 victims lost their money to a UK-led investment scam, with boiler rooms being in South East Asia (referred to as the “Investment Scam Asia” (ISA) Fraud”). More than 110 shell companies (for fictitious Trading Companies) in Hongkong, with more than 110 bank accounts, 78 of them in Hongkong, were established in the period between June 2013 and February 2021, thereof more than 33 bank accounts were opened with HSBC.

We claim that HSBC either knew about the wrongdoing or at least wilfully acted negligent regarding the fraudulent activities within its enterprise related to the two fraud schemes.

Therefore, we assume that HSBC participated in an association-in-fact enterprise with the TCOs and made themselves accomplices in defrauding thousands of unsuspecting European retail investors. We assume that HSBC’s actions, namely the deliberate neglect of a legally required adequate set-up of a risk management system and other organisational units to prevent money laundering, were motivated by pure economic self-interest in order to gain a competitive advantage.

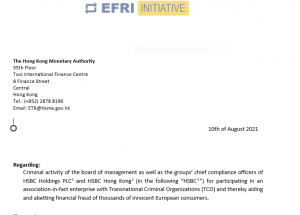

Based on our findings regarding the involvement of above all HSBC HK in scamming activities, we have filed an extensive criminal complaint regarding the involvement of HSBC in the scamming business with all relevant authorities in Hong Kong and Europe.

In case you are interested in reading the full document, pls check it out here. For information on the attachments, please contact us (e.sixt@efri.io).

We will report back on how the supervisory authorities – the ones who actually are responsible for proper implementation of AML/TF regulation in the financial system – will handle this criminal complaint.

* (1) Hang Seng Bank is a subsidiary of the HSBC group with HSBC management being part of the board of directors of the Hang Seng Bank (source: Hang Seng Bank annual report 2019). HSBC group owns 62.14 % of Hang Seng Bank (source: Yahoo Finance, Wikipedia).

The author, Elfriede Sixt ist Wirtschaftsprüferin, Steuerberaterin. Sie absolvierte bereits im Jahre 1993 die Prüfung zum US CPA und war in der Folge jahrelang als Gesellschafterin und Geschäftsführerin von Ernst & Young Wien tätig. Frau Mag. Sixt beschäftigt sich seit vielen Jahren mit dem Thema FinTech. Sie beschäftigt sich mit Themen wie Crowdfunding und publiziert zu Themen aus diesem Bereich (beispielsweise das Buch “Schwarmökonomie und Crowdfunding” im SpringerGabler Verlag) und Kryptowährungen. Im September 2016 wurde ihr zweites Buch: Bitcoin und andere dezentrale Transaktionssysteme /Blockchains als Basis einer Kryptoökonomie veröffentlicht. Seit 2018 beschäftigt sich Frau Mag. Sixt mit Cybercrime, sie gründete den Verein EFRI – European Funds Recovery Initiative, der sich mit Cyber-Betrug an Konsumenten beschäftigt und adressiert dabei auch die Problematik der Geldwäscheproblematik bei europäischen Finanzdienstleistern.

ochuko evidence Reageren

You ought to participate in a contest for one of the best blogs on the internet. I'm going to suggest this website to you!