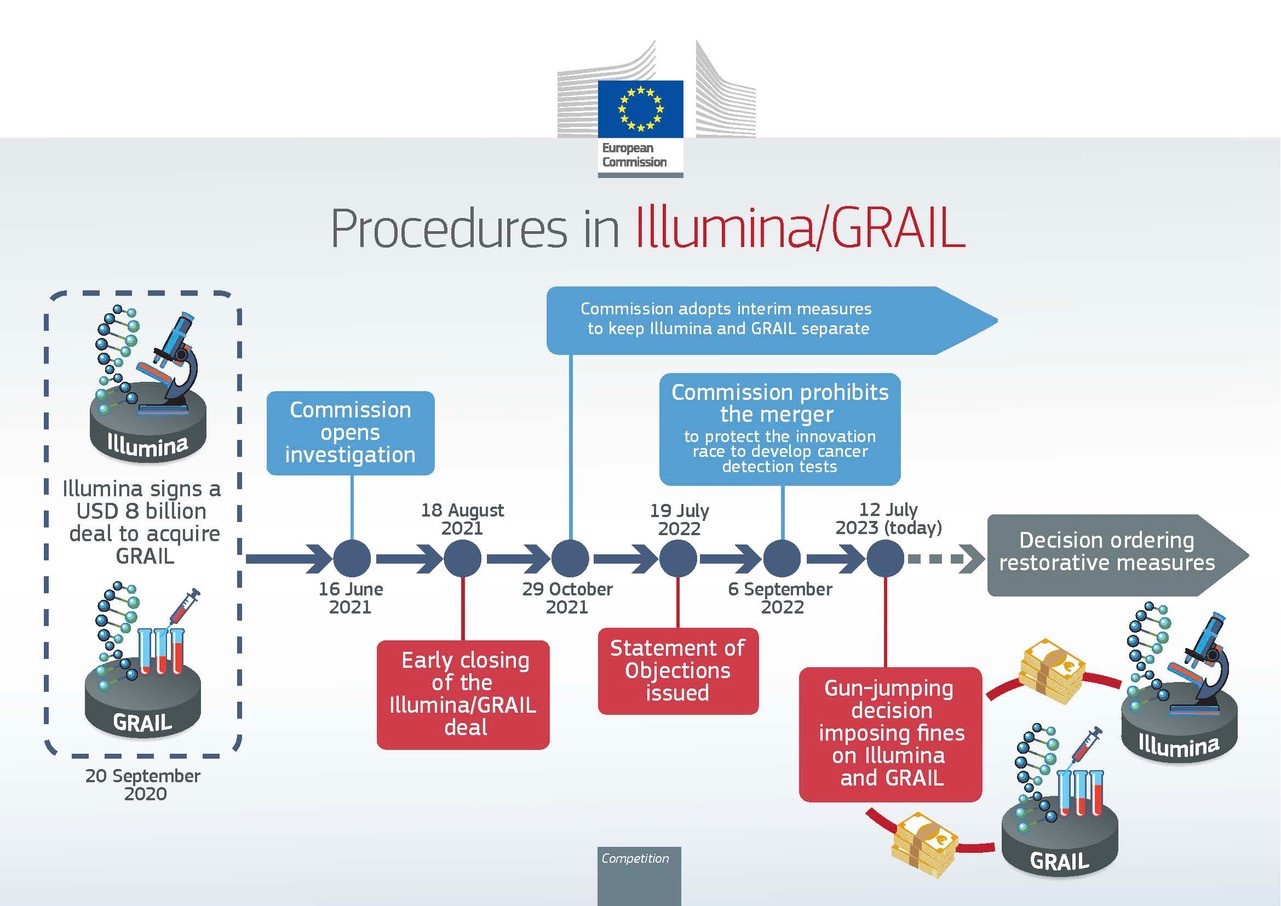

The European Commission has fined Illumina and GRAIL approximately €432 million and €1,000 respectively, for implementing their proposed merger before approval by the Commission, in breach of EU merger control rules. EU merger rules require that merging companies not to implement mergers until approved by the Commission (“the standstill obligation”). It is a cornerstone of the European merger control system, that enables the Commission to carry-out its role before structural changes modify the competitive landscape. In July 2021, the Commission opened an in-depth investigation into Illumina’s acquisition of GRAIL. In September 2022, the Commission blocked the transaction over concerns that it would have significant anticompetitive effects, stifling innovation and reducing choice in the emerging market for blood-based early cancer detection tests. In August 2021, however, while the Commission’s review was still ongoing, Illumina publicly announced that it had completed its acquisition of GRAIL. Continue reading…

Gone are the days when organisations could simply promise a speak up culture. Today, fostering a culture of trust, integrity, and a positive work environment…

Download whitepaper