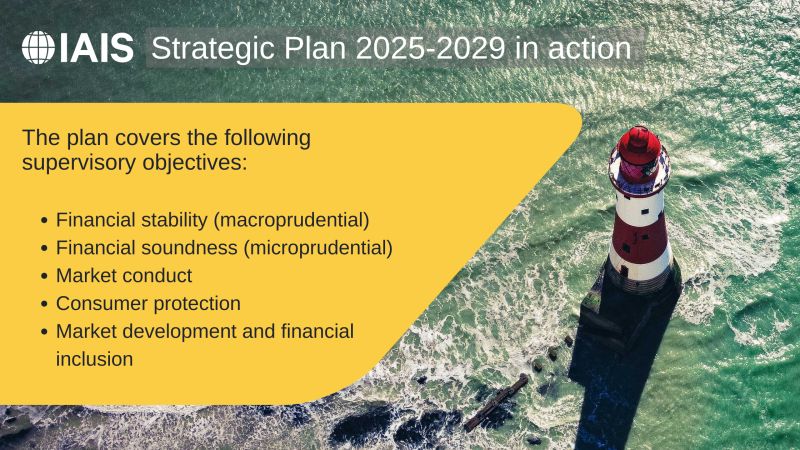

The International Association of Insurance Supervisors (IAIS) has published its Roadmap 2025-2026, the first under the new IAIS Strategic Plan 2025-2029. The Roadmap outlines the projects and activities the IAIS will undertake in support of its four core objectives – namely to:

Monitor and respond to key risks and trends in the global insurance sector; Set and maintain globally recognised standards for supervision that are effective and proportionate; Support members by sharing good supervisory practices, promoting understanding of supervisory issues and facilitating capacity building; and Assess comprehensive and globally consistent implementation of global standards.Gone are the days when organisations could simply promise a speak up culture. Today, fostering a culture of trust, integrity, and a positive work environment…

Download whitepaper